When it comes to medical coding, looking into the various codes is crucial. Different universal codes apply to all insurance carriers in the United States. However, listing all of them here would make this into a book. Today, let’s focus on revenue codes and their significance in medical billing.

Hospital revenue codes are essential in the healthcare industry for billing and reimbursement purposes. These codes help identify the specific services, accommodations, and billing calculations related to a patient’s claim. Revenue codes consist of digit numbers and inform insurance companies about the type and location of services provided to a patient.

What is the Revenue Code?

Hospital revenue codes are a combination of letters and numbers that healthcare providers use to classify patients’ services. These codes are crucial for precise billing and reimbursement because they help insurance companies determine the services provided and the appropriate payment amount.

3 Different Sets of Codes

Hospitals run on three sets of universal codes:

- ICD-9—for diagnoses

- CPT—for procedures

- HCPCS—for medical goods and services.

Purpose of Revenue Codes

We used rev code in healthcare facilities to show where a procedure or treatment is done. This helps insurance companies know the type, location, and supplies used for a procedure when they pay. We use revenue codes in billing forms to group similar charges together, making it easier to bill.

Importance of Accurate Coding

Accurate coding is crucial in ensuring that hospitals receive proper service payments. When a hospital codes a service incorrectly, it can result in the insurance company denying the claim or paying a reduced amount. This can have significant financial implications for the hospital. Moreover, inaccurate coding can lead to other issues, including:

Payment delays

If a claim is denied or requires additional information, it can take weeks or even months for the hospital to receive the payment they owe.

Audits

Audits by insurance companies or government agencies may subject hospitals with a high rate of coding errors to audits to ensure compliance and accuracy.

Reputation damage

Inaccurate coding can harm a hospital’s reputation, making it challenging

to attract new patients. Hospitals must maintain a reputation for accuracy and reliability in their coding practices.

Different types of hospital revenue codes

Revenue code in medical billing is a standardized system that plays a leading role in medical billing. These codes, consisting of three or four digits, help identify specific accommodations, services, and unique billing calculations related to a patient’s claim. They are essential for accurate claim processing and reimbursement.

The National Uniform Billing Committee (NUBC) maintains these revenue codes used in UB-04 or CMS-1450 forms. Their purpose is to group similar charges onto one line, making it easier for insurance companies to identify the type, location, and supplies used for a procedure during payment processing.

Let’s take a look at different hospital revenue codes:

- Emergency Room (ER): we use revenue code 450 for emergency room services, while it specifically used code 0761 for treatment within the emergency room.

- Operating Room (OR): we assign the Revenue code 0360 to operating room services. Different codes distinguish between various surgeries or procedures performed in the OR.

- Maternity Ward: we used the Revenue code 0700 for maternity ward services. Additional codes specify the type of delivery, such as standard or cesarean.

- Recovery Room: they designated Revenue code 0710 for recovery room services.

- Outpatient Services: they employed the Revenue Code 0670 for outpatient services. Codes 0671 to 0679 are then used to specify the type of outpatient facility, whether hospital-owned or contracted.

These revenue codes streamline the billing process and ensure accurate reimbursement for healthcare providers.

Revenue Code Examples

Revenue codes used to be only three digits long in the beginning. However, due to the addition of new codes, they now require four digits. Nowadays, most codes consist of 4 digits, with the first digit always zero. Insurance agencies have learned to assume that the first digit of each code is zero.

These examples highlight just a few differences among revenue codes, but the actual list of codes is quite extensive. There are more than a hundred different categories of revenue codes. To give you an idea, here are some famous revenue code list examples.

INTENSIVE CARE UNIT

They classify revenue codes that provide details for intensive care under the Intensive Care Unit code or 20x. There are additional sub-categories based on the procedures, treatment, and services offered:

- General – 200

- Surgical – 201

- Medical – 202

- Pediatric – 203

- Psychiatric – 204

- Intermediate ICU – 206

- Burn Care – 207

- Trauma – 208

- Other – 209

PHARMACY

Revenue codes that outline the details of pharmaceutical treatment fall under the Pharmacy code or 25x. There are additional sub-categories based on the type of treatment or medicine provided. These include:

- General – 250

- Generic Drugs – 251

- Non-generic Drugs – 252

- Take Home Drugs – 253

- Drugs incidental to other Diagnostic Services – 254

- Drugs incidental to Radiology – 255

- Experimental Drugs – 256

- Non-prescription – 257

- IV Solutions – 258

- Other Pharmacy – 259

PHYSICAL THERAPY

Revenue codes that outline the details of physical therapy services fall under the Physical Therapy code or 42x. There are additional sub-categories that are applicable based on the specific type of treatment and service rendered:

- General – 420

- Visit Charge – 421

- Hourly Charge – 422

- Group Rate – 423

- Evaluation or Reevaluation – 424

- Other Physical Therapy – 429

EMERGENCY ROOM

Revenue codes that outline the details of emergency room visits fall under the Emergency Room code or 45x. There are additional sub-categories that are applicable based on the location and services offered:

- General – 450

- Emergency Medical Screening Services – 451

- ER Screening – 452

- Urgent Care – 456

- Other Emergency Room – 459

Conclusion

Hospital revenue codes play a vital role in the daily tasks of medical coders. They exist to simplify the complex process of medical coding and billing. Every coding team must receive proper education and training on these codes and maintain detailed documentation of current procedures.

Ensuring the accuracy of your coding is crucial in ensuring that your facility receives the appropriate reimbursement for the services provided. This significantly contributes to the revenue cycle and minimizes claim denials.

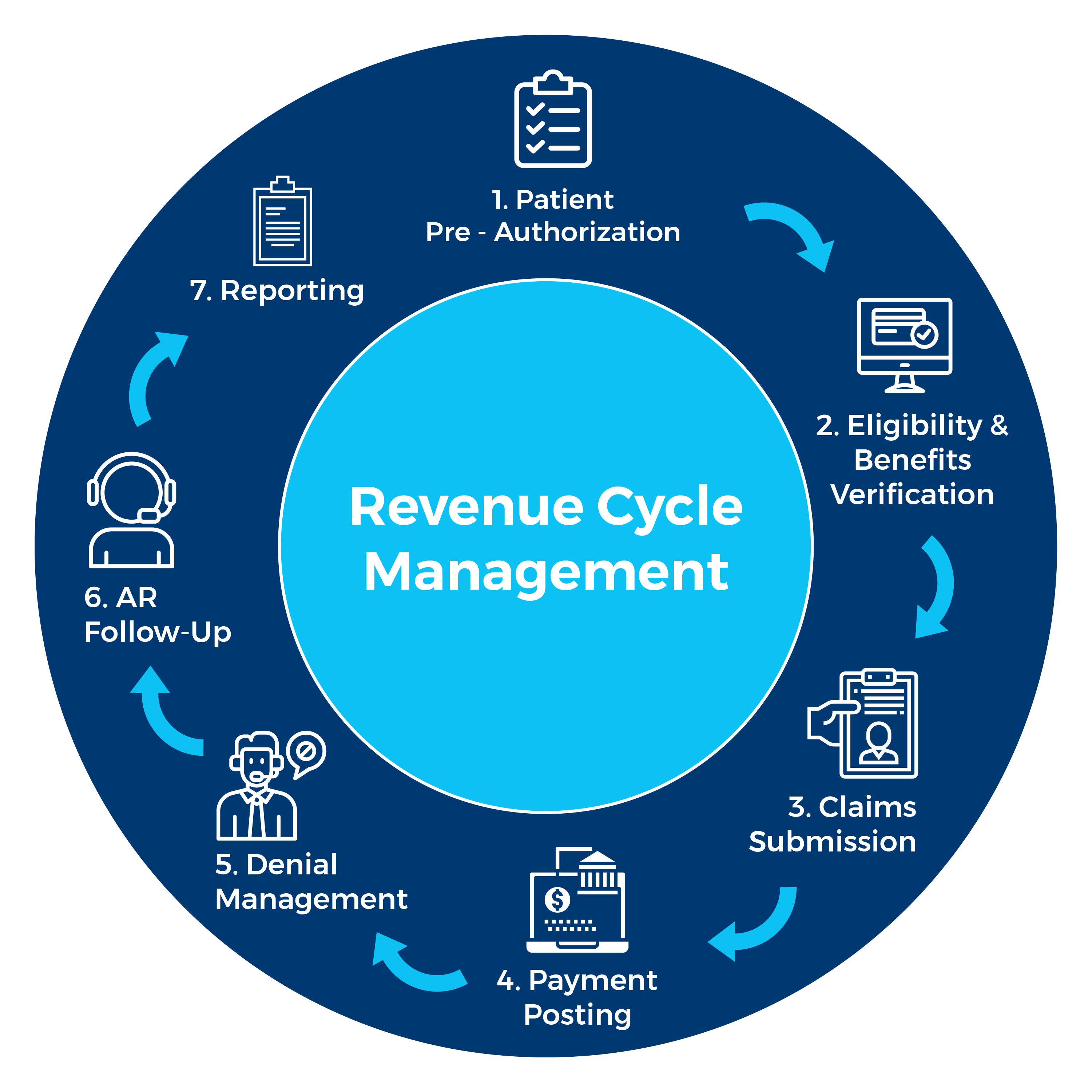

This is why many companies outsource their revenue cycle management to specialized third-party organizations, focusing on universal codes and reducing denial rates. By freeing up their coding team from tedious administrative work, companies can enhance the overall quality of their revenue cycle.